Valitor Raises $28M Series B to Develop Therapy for Age-Related Macular Degeneration

From the story by Kyle LaHucik at Endpoints News

Largely funded by government grants for the better part of its first decade, a UC Berkeley spinout has secured a new CEO and the funds to take its research into the clinic in early 2024.

The biotech, named by one of the co-founder’s daughters and originally scrapped together with NIH funds in the aftermath of the 2008-09 financial crisis, is also on a mission to upend the treatment of wet age-related macular degeneration, or AMD, with an injectable drug that it claims could be more durable than the “800-pound gorilla” in the room, Genentech’s Lucentis and Regeneron/Bayer’s Eylea.

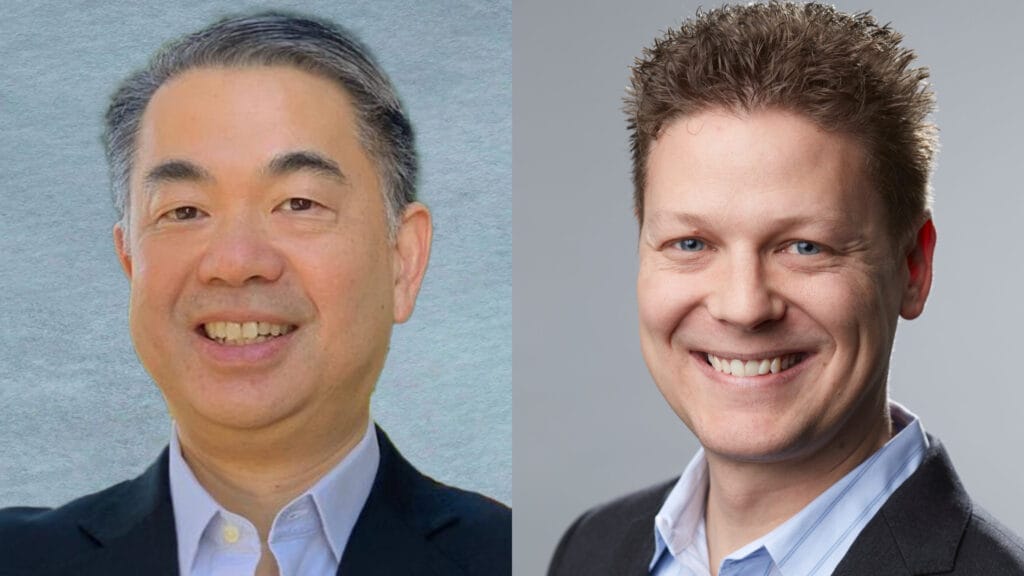

Valitor raised $28 million via a Series B led by Morningside, the 10-employee California biotech disclosed Wednesday morning. The upstart also got a new leader: Steven Lo, the chief executive who recently led Zosano Pharma, a biotech that attempted to develop a migraine treatment but went through multiple hurdles that led to bankruptcy filing this summer.

The company will spend next year testing its multivalent polymer to prep for a clinical trial in 2024. The goal is to create an injectable that can last six months, meaning patients with wet AMD, a chronic eye condition that blurs vision and can sometimes cause blind spots, would only need two injections per year, kind of like going to the dentist, quipped Wesley Jackson, co-founder, president and CSO, in an interview with Endpoints News ahead of the launch.

“It’s a market where, as I joke, a bunch of us are getting older,” Lo said in a joint interview with Jackson, “so there’s gonna be more potential patients in that space. And even this past weekend, Wes and I were at the American Academy of Ophthalmology and just received some great reinforcement of the amount of companies that are in this space.”

At the ophthalmology conference in Chicago this past weekend, the two executives spoke with key opinion leaders and potential partners. While Valitor is focused on internal development, the biotech has drummed up “a little bit of interest. Those were, let’s say, the other types of meetings that we had at AAO,” Lo said.

The concept of treating diseases in the back region of the eye with intravitreal injections has become “just trivial,” Jackson said, as it wasn’t common practice just 15 years ago.

Jackson described the company’s lead asset as taking very long chains of biopolymers that are decorated with multiple copies of the therapeutic — as many as hundreds of antibodies or small domain proteins — that form a sphere (he mimicked the shape with his hands over Zoom) to culminate in a “really large molecular entity that is able to deliver that mechanism into the target tissue.”

The aim is to get the drug to remain durable for six months — as compared to every month or every couple months for the marketed products Valitor is going after — and stay in the back of the eye so it continues soaking up the VEGF, getting to “where the VEGF is acting and prevent it from continuing to have its pathological effects,” Jackson explained.

A “portmanteau” of valency and receptor, Valitor originally sought to treat joint disease, the focus of some of those early grants, but the company pivoted around 2016 and raised a modest Series A — in the single-digit millions — in 2018 to move forward on wet AMD. Other ophthalmologic indications are in the cards, Lo said, as are solid tumors and potentially joint disease, once again.

Jackson co-founded the biotech with two UC Berkeley professors: Kevin Healy, whose daughter coined the name, and David Schaffer. Both have founded multiple companies, including Schaffer’s Rewrite, which Intellia swooped in to acquire earlier this year.

Also on the leadership team is chief development officer Sandy White, who was previously CEO of eye-focused biotechs iDrop and Icon Bioscience.

Joining Morningside in the funding round were new investors First Spark Ventures and ExSight Ventures. Existing backers Berkeley Catalyst Fund and Pandect Bioventures also contributed.